How Much Can I Make Investing $500k: A Comprehensive Overview

November 14, 2025

Introduction

Founded in 1987 by Steven Check, Check Capital Management has built a reputation as an award-winning asset management firm. Our philosophy is straightforward: buy exceptional businesses when they're trading at bargain prices and hold them for the long term. Our management fees have us only get paid when you profit. This disciplined approach has served our clients well for nearly four decades.

Understanding Realistic Return Expectations

If you want no risk at this time, you can lock in 1-year guaranteed returns in Certificates of Deposit (CDs) and U.S. Treasuries for a little under 4%, or money markets paying about the same. These rates are always subject to change and tend to be tied to inflation conditions, employment rates and the general economy. Between 2008 – 2022 the Federal Funds rate was less than 1%. In contrast to this 15-year period, being able to achieve returns of 4% is a nice change of pace.

If you want to do better than 4%, you are going to have to take some risk. Anytime the word “risk” is added to the discussion, there is a chance you may lose some, or all, your investment. But if you are knowledgeable and disciplined with a long-term mindset, it’s reasonable to assume you can earn 6% or better over the long run. You could even earn 8% - 12% annually, or better, depending on investments made and the market conditions experienced.

As a point of reference, the S&P Index has averaged about 10% annualized over the past 50 years. The S&P Index is a widely followed and respected stock index and is used as a key benchmark that was created by Standard & Poor’s and consists of around 500 companies. The return quoted above is before taxes and any expenses.

Warren Buffett's Perspective on Current Markets

Warren Buffett, whose Berkshire Hathaway has delivered 19.9% compound annual returns from 1965 – 2024, nearly double the S&P 500's 10.4% returns over the same period, offers a uniquely valuable perspective on current market conditions. At Berkshire's 2025 annual meeting, Buffett stated, "The long-term trend is up" while acknowledging, "Nobody knows what the market is going to do tomorrow, next week, next month".

However, the Oracle of Omaha is notably cautious about current opportunities. Buffett noted, "Often, nothing looks compelling" when discussing current investment opportunities, suggesting he finds today's market expensive.

Despite his comments, Berkshire’s ownership of publicly traded stocks is valued at over $260 billion, and Buffett told shareholders, “The great majority of your money remains in equities.” He warns against trying to time markets, noting that discussions about short-term market predictions "have no value".

Berkshire Hathaway Covered Calls: An Alternative to Fixed Income

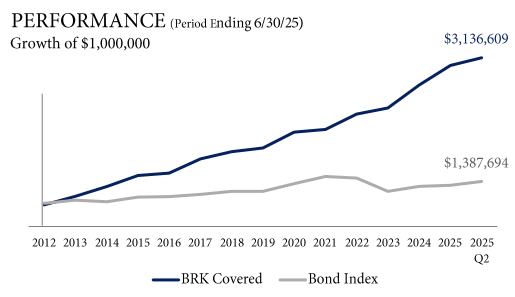

While Warren Buffett preaches patience in today's expensive market, Check Capital's Berkshire Covered Calls Program offers investors a way to reduce risk or earn income.

Check Capital’s Berkshire Covered Calls Program has provided better returns compared to most fixed income alternatives while maintaining exposure to one of America's most successful companies. Selling covered calls on Berkshire Hathaway is not speculation, but rather a way to reduce the volatility of owning the stock outright. Your upside is capped when selling a covered call, but that goes hand-in-hand with lowering volatility.

Our Berkshire covered calls program is ideal for investors who want to own Berkshire stock long-term but also seek distributions out of their investments and lower volatility of their overall portfolio. Check Capital has been managing Berkshire Hathaway covered call strategies since 2011, with no down years.

Return Scenarios for $500,000 Portfolios

For a $500,000 portfolio, current projections translate to potential annual returns of:

● Conservative scenario (4%): $20,000 per year

● Moderate scenario (7%): $35,000 per year

● Optimistic scenario (10%): $50,000 per year

● Bull market scenario (15%): $75,000 per year

However, it's crucial to understand that these are gross returns before fees, taxes, and inflation. Real-world net returns will be lower, and year-to-year volatility means some years will significantly exceed these averages while others may show losses. As Buffett emphasizes, there are periods when no compelling opportunities exist, and investors should remain patient rather than deploy capital into subpar opportunities simply for the sake of activity.

Check Capital's Investment Philosophy: Quality at the Right Price

At Check Capital Management, we don't chase market trends or attempt to time short-term movements. Instead, our value-oriented approach focuses on identifying and purchasing shares of exceptional businesses when they trade below their intrinsic value. This philosophy has several key components that directly impact potential returns on an investment.

Concentrated Quality Holdings: We typically maintain portfolios of 12 to 20 carefully selected companies, allowing us to thoroughly research each investment and take meaningful positions in our highest-conviction ideas. This concentration can lead to outperformance when our analysis proves correct, though it also means our returns may differ significantly from broader market indices.

Long-Term Perspective: Our average holding period exceeds five years, which allows us to benefit from the compound growth of exceptional businesses while avoiding the transaction costs and tax implications of frequent trading. This patient approach is particularly beneficial for substantial investments like $500,000, where the power of compounding becomes most apparent over time.

Owner-Operator Focus: We prefer companies run by management teams with significant personal stakes in the business, believing this alignment of interests creates better long-term outcomes for shareholders. These owner-operators often make decisions that prioritize sustainable business growth over short-term earnings manipulation.

Asset Allocation Strategies for $500,000 Portfolios

Check Capital's "Two-Bucket Approach" provides a framework for allocating substantial investment capital between growth-oriented equity investments and more conservative fixed-income holdings. This strategy becomes particularly important with $500,000, as it represents enough capital to create a well-diversified portfolio across multiple asset classes.

Equity Allocation for Long-Term Growth: We recommend placing money intended for long-term investment (typically five years or more) in carefully selected stocks of quality companies. Based on current market conditions and our investment process, this portion of a $500,000 portfolio might target annual returns in the 8-12% range over extended periods, though with significant year-to-year volatility.

Fixed-Income for Stability and Near-Term Needs: The conservative portion should cover near-term expenses and provide portfolio stability during market downturns. With current bond yields, this allocation might generate 4-6% annually with much lower volatility than stocks. For a $500,000 portfolio, this could provide $20,000-$30,000 in relatively predictable annual income.

Strategic Rebalancing: As markets move, we periodically rebalance between these allocations to maintain target weightings and potentially enhance returns through disciplined buy-low, sell-high actions. With $500,000 in assets, these rebalancing opportunities can meaningfully impact overall portfolio performance.

Risk Management and Capital Preservation

Check Capital's philosophy emphasizes avoiding permanent loss of capital, which becomes increasingly important as investment amounts grow. With $500,000 at stake, a 20% market decline represents a $100,000 loss – a substantial sum that could take years to recover through dividends and growth.

Our risk management approach includes several protective measures. We focus on financially strong, established companies with durable competitive advantages, reducing the risk of permanent capital impairment from business failures. We purchase stocks only when we believe they trade at significant discounts to intrinsic value, providing a "margin of safety" that helps protect against both analytical errors and market volatility. Our long-term perspective helps us avoid panic selling during temporary market downturns, allowing time for businesses to compound value and stock prices to reflect underlying business performance.

Current market conditions show the US equity market trading at a high valuation. With volatility possibly to return as various economic and policy uncertainties play out. This environment reinforces the importance of careful security selection and risk management.

Fee Structure and Performance-Based Compensation

Check Capital offers a unique fee structure that aligns our interests directly with client outcomes. Our profit-based fee option charges 10% of account profits with no minimum fee, available to “qualified clients”. This means that on a $500,000 account, we only profit when you profit, creating powerful incentives for us to focus on generating positive returns rather than simply gathering assets.

For example, if your $500,000 account grows by $50,000 in a year (a 10% return), our fee would be $5,000 (10% of the $50,000 profit), leaving you with a net gain of $45,000. In years when the account doesn't generate gains, you pay no management fees. This structure is particularly attractive for substantial accounts, as it ensures fee levels remain reasonable relative to returns achieved.

Most of our clients choose this performance-based fee structure over traditional asset-based fees, reflecting their confidence in our ability to generate attractive risk-adjusted returns over time.

Market Timing vs. Time in Market

One of the most common questions from investors with $500,000 to deploy is whether they should invest all at once or dollar-cost average over time. While market timing appears attractive, especially given current elevated valuations, our experience suggests that “time in the market” generally proves more important than timing the market.

Current market conditions include elevated valuations, ongoing tariff uncertainties, and Federal Reserve policy decisions that create near-term volatility. However, these uncertainties always exist in some form, and waiting for perfect conditions often means missing the compound growth that drives long-term wealth creation.

For substantial investments like $500,000, a reasonable approach might involve investing the majority of funds relatively quickly while maintaining some cash reserves to take advantage of any significant market dislocations that may occur.

Economic Environment and Future Outlook

Understanding the current economic environment helps set realistic expectations for investment returns. The 2025 market faces challenges including elevated tariff rates, continued inflation concerns, and expensive stock valuations. These factors suggest that while positive returns remain likely over longer periods, near-term volatility should be expected.

Professional forecasts generally expect more modest returns in coming years compared to the exceptional performance of 2022-2024. This environment favors investment approaches that emphasize quality, valuation discipline, and risk management – core tenets of Check Capital's methodology.

For investors with $500,000 to deploy, this environment reinforces the importance of working with experienced professionals who can navigate changing conditions while maintaining focus on long-term wealth-building objectives.

Conclusion

Investing $500,000 represents both a significant opportunity and responsibility. While potential annual returns could range from $25,000 to $75,000 or more, depending on market conditions and investment approach, the path to achieving these returns requires careful planning, disciplined execution, and professional management.

Check Capital Management's value-oriented philosophy, concentrated portfolio approach, and profit-based fee structure align our interests with yours in pursuing attractive risk-adjusted returns over time. Our focus on quality companies purchased at reasonable prices, combined with a long-term investment horizon, positions substantial portfolios like yours to compound wealth while managing downside risks.

The key to successful investing with $500,000 lies not in chasing the highest possible returns, but in finding the right balance between growth potential and risk management that allows your wealth to grow steadily over decades. Through our disciplined approach and proven track record since 1987, Check Capital stands ready to help you achieve your long-term financial objectives.

Frequently Asked Questions

What is the minimum investment required at Check Capital Management?

Check Capital Management requires a minimum investment of $500,000 to open an account. This threshold allows us to provide personalized attention and implement our concentrated portfolio strategy effectively for each client.

How does the profit-based fee structure work?

Our profit-based fee is 10% of account profits with no minimum fee. You only pay when your account generates positive returns. For example, if your $500,000 account gains $40,000 in a year, the fee would be $4,000 (10% of profits), leaving you with a net gain of $36,000. In years without profits, you pay no management fees. The following year your account would start with high-water value of $540,000 and you wouldn’t be charged a fee until it surpassed that value again on a subsequent anniversary date. To participate in this fee structure the SEC requires a person or entity to be a “qualified client”. A qualified client is defined as having either 1) net worth of $2,200,000 exclusive of any equity in your primary residence, or 2) $1,100,000 of assets under management by Check Capital Management. Feel free to call us to discuss these details.

What types of companies does Check Capital typically invest in?

We focus on exceptional businesses that are industry leaders with favorable economics, capable of growing earnings for decades. Most of our holdings are multinational companies with long operating histories, many paying dividends that have been raised consistently over decades. We prefer companies run by owner-operators with significant personal stakes in the business.

How many stocks are typically in a Check Capital portfolio?

Our portfolios are concentrated, typically holding 12 to 20 carefully selected companies. This concentration allows us to thoroughly research each investment and take meaningful positions in our highest-conviction ideas, though it also means returns may differ significantly from broader market indices.

Can I access my money at any time?

Yes, accounts are held at major, independent brokerage firms where you retain full and immediate access. Check Capital doesn't serve as the custodian, which ensures you maintain control and liquidity of your investments.

What is Check Capital's track record?

Check Capital Management has been an SEC-registered investment advisor since 1987 and currently manages approximately $2.2 billion for over 1,200 clients across 46 states. Our long-term approach has allowed us to build lasting relationships with clients, with our average holding period exceeding five years.

How does Check Capital's approach differ from index investing?

Unlike broad market index funds, we employ active management with a concentrated portfolio of carefully selected companies. We focus on purchasing quality businesses at attractive prices rather than simply tracking market performance. This approach can lead to outperformance over time, though it also means our returns will differ from market indices.

What happens during market downturns?

Our investment philosophy emphasizes avoiding permanent loss of capital through ownership of financially strong, established companies purchased at discount prices. During market volatility, we maintain our long-term perspective and use our business-owner mentality to focus on underlying company fundamentals rather than short-term stock price movements.

Is my $500,000 investment insured or protected?

While investments are subject to market risk and are not insured by the FDIC, accounts are held at major brokerage firms that provide SIPC protection up to $500,000 in securities. Check Capital maintains a compliance officer and follows strict fiduciary standards as an SEC-registered investment advisor.

How often will I receive updates on my investment performance?

You have immediate online access to your account through your chosen brokerage firm. Check Capital provides regular communication about portfolio activities, market outlook, and performance updates. Our relationship officers ensure you stay informed about your investments and any changes to our investment thesis.