A Tribute to Charlie Munger

A special edition of the Blue Chip Investor, dedicated to Charlie Munger.

January 1, 1924 – November 28, 2023

Charles T. Munger—known by most as "Charlie"—passed away on November 28th, 2023 one month short of age 100. He was Warren Buffett's partner in building Berkshire Hathaway over the last 50 years.

Charlie was one of the most amazing men to have ever lived. I became aware of him in the 1990s when I read the first books about Warren Buffett. The more you were exposed to Charlie, the more you liked him. I've attended the Berkshire Hathaway annual meetings in Omaha since 1996. At these meetings, Warren does most of the talking, but Charlie was always there with succinct, piercing and often funny follow-on thoughts. The two were a "businessman act" unlike any other.

Charlie grew up in Omaha but moved to Los Angeles when he was in his early 20s. The big city of L.A. suited Charlie more than the smaller confines of Omaha. In Los Angeles, he founded the renowned law firm now known as Munger, Tolles & Olson. At Buffett’s urging, Charlie then started an investment partnership that he managed successfully until 1976. And even after joining Buffett at Berkshire, Charlie was the Chairman of two publicly traded companies, Wesco Financial (until 2011) and Daily Journal Corporation (until 2022).

Since Wesco and the Daily Journal were L.A.-based companies not far from me, I started attending their annual meetings before they became quite popular. I believe my first Wesco meeting was in 1996. It was held next to a cafeteria on Colorado Boulevard in Pasadena. There were about 20 shareholders in attendance. I remember that among the shareholders was Alan Cranston, the prominent former U.S. Senator from California. Charlie barely acknowledged him as he went about the business of the meeting.

I began to attend Daily Journal meetings in the early 2000s when they were held at the Daily Journal headquarters. There were about five shareholders at my early meetings, and we sat around a conference-room table with Charlie, the board of directors and the outside accountants.

For more than 25 years, I've been fascinated by Charlie. I attended over 50 company annual meetings with Charlie being either the Chairman or the Vice Chairman. I've watched videos and read books about him. Charlie affectionately called us—his followers—"groupies".

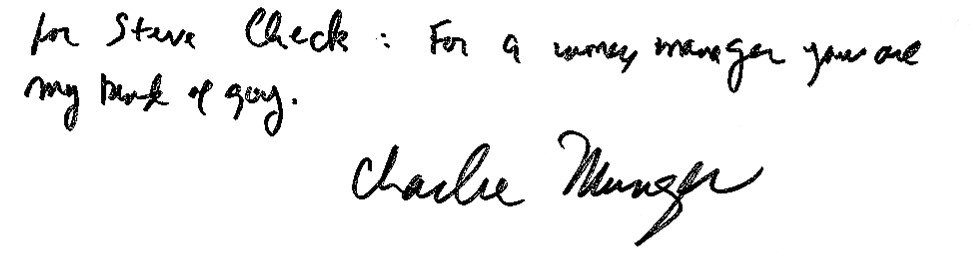

After the wonderful book Poor Charlie's Almanack was published by Peter Kaufman in 2005, I wrote a complimentary online review. Peter reached out, offering to send me a personalized Charlie-signed copy. While I knew Charlie didn't think highly of most money managers, he was OK with those who took a Buffett/Munger approach. I asked to have Charlie sign my book, "For a money manager, you are my kind of guy." Before long, I received the book and a note from Peter stating that Charlie got a real chuckle out of my story and was happy to sign the book as I suggested. It's one of my prized possessions.

“For Steve Check: For a money manager you are my kind of guy. Charlie Munger”

There's been a lot written about Charlie and much can be found online. Charlie was extremely smart, funny and successful. But more than any other word, I'd describe Charlie as "curious". He loved trying to figure out how people and things worked. He enjoyed science, philosophy, business and people. He understood the human condition. He was a joyful man who was often amused at what he observed. He lived in a deliberate manner, truly getting the most of each day. He kept busy right up to the end of his life, probably figuring he'd have plenty of time to rest when he was dead.

The world will be a less interesting place with Charlie no longer in it. That said, Charlie always preached learning from the eminent dead, and Charlie's personal hero was Ben Franklin. Charlie left us with much wisdom and many lessons. And while the living Charlie is no longer with us, we can always lean on his teachings. With investing, his big four were: 1) Preparation, 2) Discipline, 3) Patience and 4) Decisiveness. He hated "thumb sucking". Whenever the odds were heavily in your favor, he always counseled betting big.

To learn more contact Check Capital at (714) 641-3579 or info@checkcapital.com.